The trusted brand of Thomas cook is facing an uncertain future. Thomas Cook has always been a much loved high street travel brand – but the high street is changing, with many UK retailers closing. And Thomas Cook, despite its 170 year plus heritage in international travel, is no exception.

Could Brexit and global warming finish it off?

Amidst Brexit fears, and a record heatwave keeping UK customers at home this summer (or so Thomas Cook is claiming) the travel company has recorded an annual loss of £160M. What does this mean for consumers?

Well for now it is business as usual. No instant closures of either the airline, its tour packages, cruise tours, bricks and mortar shops, or hotels have been announced. Customers can also feel reassured that the company is taking steps to rationalise the business and diversify. For example it has confirmed it will expand its hotel chain, with 20 new own branded hotels, under the brand Casa Cook, in the Mediterranean (Spain, Greece and Turkey) for next year. Sales to its own brand hotels are up 15percent. This is clearly a sensible move since it based on aligned growth. The addition of the 20 new hotels will bring the total number of Thomas Cook hotels to 200, and provide capacity of 40,000 rooms.

And also, whilst profits have slumped by £58M, it still recorded a profit of £250M which is not to be sniffed at.

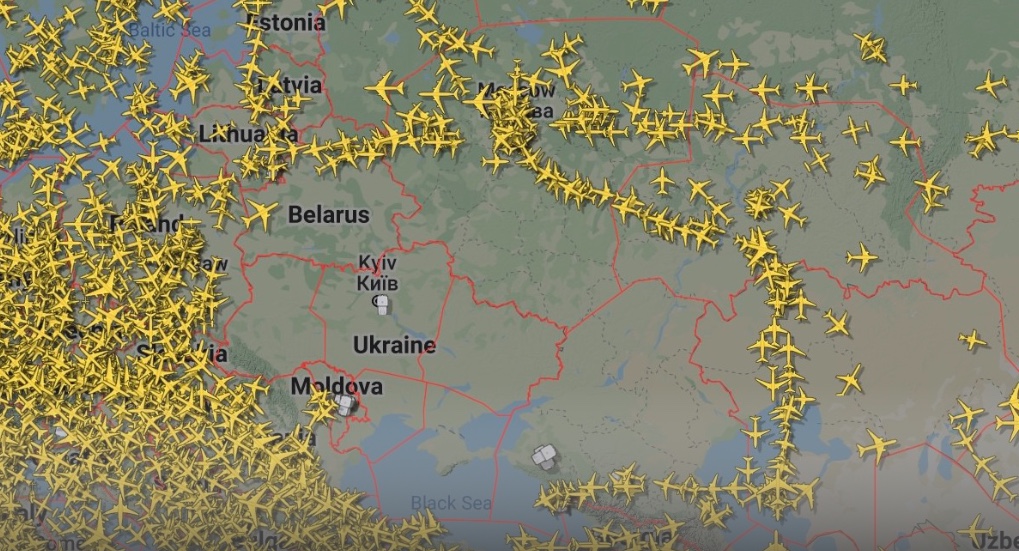

CEO Peter Fankhauser says, ‘Profit in our tour operating business fell £88 million as the sustained heatwave restricted our ability to achieve the planned margins in the last quarter. The UK was particularly hard hit with very high levels of promotional activity coming on top of an already competitive market for holidays to Spain. Despite the impact of the hot summer, our Northern European tour operator achieved a near record performance, albeit lower than that expected at the end of May. Meanwhile, our Group Airline delivered strong growth in customers and profit, up £35 million, benefitting from increasing capacity in a turbulent European aviation sector.’

Thomas Cook Airlines operates a modern fleet of 25 Airbus A321s, and six widebody A330-200s from ten UK bases, to destinations both shorthaul and longhaul.

But with competition from the aggressive low-cost market – is this sustainable? It has tie-ups with many other airlines including easyJet, which is a good move, but nevertheless could be of more benefit to easyJet than vice versa.

But to Thomas Cook’s strength, it is seeing growth in the longhaul market – which is encouraging.

But this familiar brand needs to keep pace with changing trends, more self-packaging travel choices by younger audiences reflecting a changing demographic globally.

Younger audiences may not be as ingrained in their recognition of established travel brands, as older generations. Disruptive technology is the driver of consumer travel trends.

It does not bode well that Thomas Cook closed its Hotels4u bedbank in 2015.

To this end, Thomas Cook is getting it right by addressing digital, by planning to integrate Expedia technology and content in its first five markets.

But then there are other circumstances well beyond its control such as Brexit. The prospect of Brexit impacts on travel in and out of the UK could be giving many of its core market customers the jitters, even though there is no sign yet of any negative outcome post-Brexit, in the travel sector.

Even though Thomas Cook seems to be recognising its weaknesses, is it lean and agile enough to cope with the slings and arrows of outrageous fortune epitomised by low customer confidence, climate change (heatwaves deterring travel) and the looming monolith of Brexit?

This is a question that even Fankhauser doesn’t yet have the answer to.

Sally Gethin is an independent expert on travel and aviation. She comments for BBC News and other channels. To book Sally for broadcast comment live on air, please contact Sally through www.gethinsinflight.com or direct to publisher@gethinsinflight.com

Sally is also available for private and corporate speaking engagements at Specialist Speakers