What will airlines be focussing on this year?

Protecting passenger data will become a major topic. The EU directive General Data Protection Regulation (GDPR) which comes into effect 25 May, will regulate the management of personal data within Europe with impacts outside the EU. Airlines which handle data of EU domiciled residents will be affected.

Airlines process vast amounts of data from passengers such as reservations transactions and frequent flyer memberships. Airlines will have to show they are complying in full with the new legal imperative. It will mean more detailed procedures, more human resources and data tools dedicated to the task.

This could in turn lead to greater scrutiny of all types of airline customer data, including those gathered in intelligence gathering and surveillance onboard. IFE systems incorporating sensors to analyse individual passenger mood including listening software to record onboard conversations, might not be welcome by the traveling public and require a higher standard of integrity and scrutiny by regulators.

Europe also ushers in a new era of inflight wi-fi across the 28 EU states with the aptly named European Aviation Network, a hybrid technology combining Inmarsat’s S band satellite and a ground tower network from Deutsche Telekom. EAN is expected to launch this year and reduce pricing both for airlines and their customers. Launch customer is IAG with a contract for 300 aircraft installations. At 75mbps per aircraft it will usher in a new era of high-speed broadband inflight in Europe, competitive to other global services.

Functionalities will include IP based services such as internet browsing, video streaming, and gaming. It will also provide a user experience similar to GSM data services like text SMS. This can be done over wi-fi using IP based messaging such as iMessage, whatsapp and Messenger.

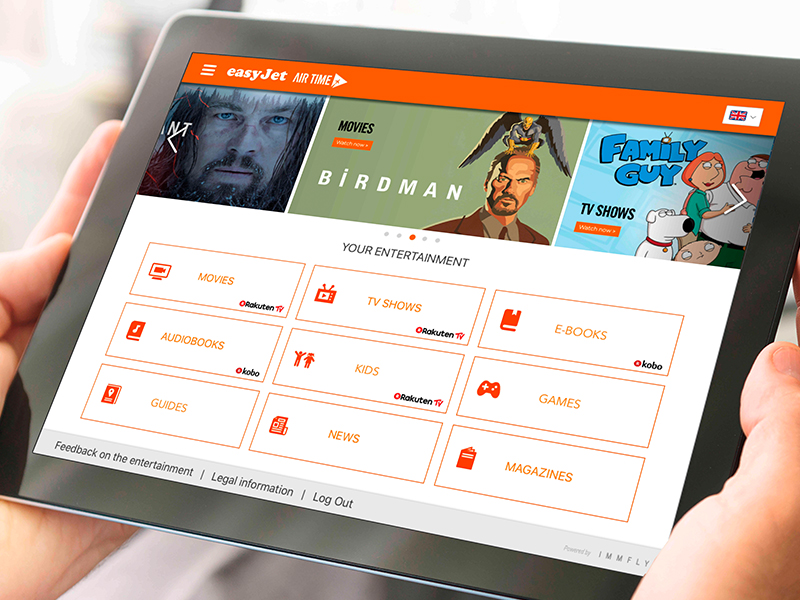

Airlines globally will continue to take delivery of inflight entertainment, onboard wi-fi, and wireless content delivery technologies for Personal Electronic Devices (PEDS) with a more intensified focus on enhanced revenues. These revenues may be managed by the technology providers themselves such as Global Eagle or third party providers such as Immfly.

Portable inflight entertainment options previously known as ‘suitcase IFE’ will continue to offer an ideal inflight entertainment experience to both low fare carriers and larger aircraft. Without the expense of inseat monitors and cabling, these systems will continue to disrupt the traditional embedded IFE market. There are an increasing number of providers – AirFi, Lufthansa Systems, BlueBox Avionics among others.

However the role of the inseat monitor is likely to continue, especially in premium cabins on longhaul flights. The higher cost of business and first class seats sets an expectation for a personal and more immersive inflight entertainment experience replete with all the latest enhancements such as HD-video, noise cancelling headsets, second screen viewing and even gesture control (although this is yet to materialize).

Expect to hear more this year on inflight Virtual Reality. Air France’s

new Joon subsidiary will be launch customer for a new VR headset branded Allosky from Skylights, to be followed by ‘several pilot projects also planned around the world’.

Despite hesitation in the market, Air France plans to offer the headset onboard in the Spring. The headset has been customized for inflight with a sleek, lightweight design, full HD resolution and focus correction for eyesight.

Rival providers will be watching this somewhat early adoption to evaluate market potential for similar solutions. So far inflight VR has been met with widespread scepticism mainly due to concerns over vertigo, nausea, disorientation, headaches and headset weight.

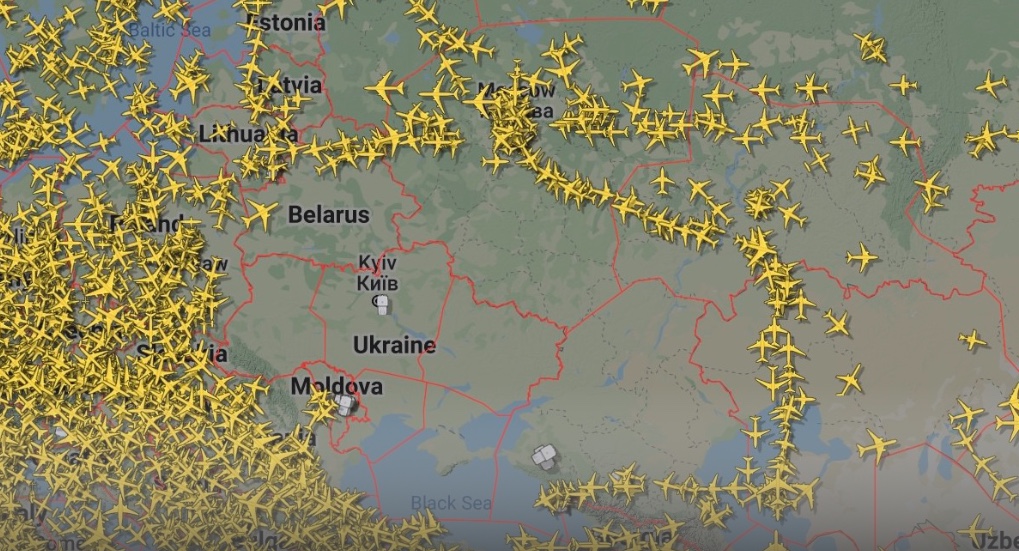

Delivery of inflight wi-fi and other types of connectivity such as mobile/cellular phone usage for data will maintain an upwards trajectory. Gogo for example has over 2000 aircraft awarded with its 2Ku system.

USA newcomer SmartSky Networks also plans to launch service in 2018, providing US airlines with a low cost Air To Ground service for inflight wi-fi.

Backbone enablers – satellite networks – will usher in faster bandwidth and improved service to passengers onboard. ViaSat launched its High Throughput Satellite ViaSat 2 in 2017 for example – this will become operational next month, providing more than 300 gigabits per second (gbps) of total network capacity, as well as seven times the broadband coverage of its first-generation satellite.

Trade body Airline Passenger Experience Association may make a difference with its new committee aimed at standardising inflight wi-fi technologies. If so, airlines may like the results which could harmonise components and technologies and render comparison checks among providers more transparent. However, standardization might also reduce competition in the market and potentially lead to consolidation.