Two giants in inflight connectivity are joining forces to boost capacity for airlines in North America and around the world.

The networks will cater to the demands of data-hungry passengers who want reliable, affordable, high-speed Wi-Fi while on board their flights. It will boost capacity in North America, a mature market for IFC, where capacity is considerably constrained.

Deliverable from end 2021, GX+ North America seamlessly integrates Hughes JUPITER™ High-Throughput Satellite (HTS) constellation across North America with the worldwide Inmarsat Global Xpress (GX) HTS satellite network.

Speaking exclusively to Gethin’s Inflight News, Inmarsat president of aviation, Philip Balaam says, ‘We are wrapping the two networks together to create a seamless connectivity experience, no matter where you are.’

Inmarsat and Hughes seven satellites will expand to 15 in the next four years. This creates ‘a very strong resilient network which we can layer on capacity over time’, says Balaam. The network covers the entire globe but with Hughes combined, offers greater capacity to tide airlines well into the future.

The problem many airlines in North America face, is outdated legacy Inflight Connectivity systems, which can no longer provide sufficient bandwidth inflight.

This new solution creates capacity well into the future. Balaam says that airlines are asking for bandwidth to scale up to demands in five, ten or even 15 years ahead. The GX+ North America is designed to solve this long term capacity dilemma. Many are stuck with legacy systems already installed on their fleets. ‘Once on, it is difficult to get them off, ‘ says Balaam.

By contrast, the Inmarsat Hughes solution will ‘unlock their ambitions’.The switch to newer aircraft will likely expedite the need for a new solution.

As the pandemic continues, many airlines are ditching their older fleets for newer more fuel efficient aircraft types. ‘Older aircraft are being retired to be replaced by newer aircraft with connectivity at their core.’

This in turn will spur airlines to monetise the onboard service either through sponsorship, associated advertising or pay for access.

If you get high quality consistent serve you can sell it for third parties to pay for. It creates access to a high value audience in a tube. Passengers on a fight with good wifi are more likely to return to that airline providing that service.’

It might seem a strange time to launch such a service, but Balaam believes the time has never been so right. ‘This service will be competitive with legacy systems.’

He argues that in the future there will be increasing regulatory pressure on airlines to meet ‘the green agenda’. Replacing legacy IFC systems will help airlines meet that need.

The onboard system is both backwards and forwards compatible, requiring no retrofits or modifications to existing equipment operating on current Inmarsat GX aviation customers.

Hughes executive vice president and general manager, North America division Paul Gaske says, ‘We are proud to partner with Inmarsat to launch GX+ North America. This unique strategic collaboration leverages the full power of the JUPITER System, including the depth of capacity of our Ka-band High-Throughput Satellite fleet, as well as our JUPITER gateways and modems. Combining the Hughes JUPITER System and Inmarsat’s leading inflight connectivity solution, GX+ North America marks a new era for inflight connectivity.’

The new solution will be provided and managed end-to-end by Inmarsat. Prototype flights are expected to start later this year with commercial availability scheduled for 2021.

GREEN SHOOTS

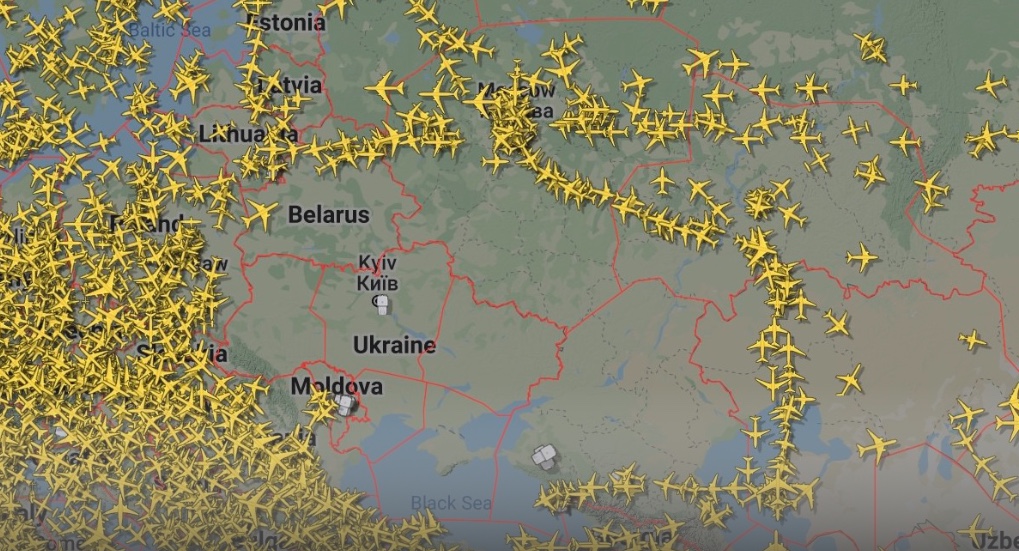

Despite the pandemic, some parts of the world still beckon. Regions where IFC markets are growing include China, Southeast Asia and India according to Balaam. ‘It may take a little time but aviation is extremely resilient. We’ll see European majors (airlines) coming back strong, LCC’s too.’

Whilst there have been ‘slowdowns’ in the number of flights, Inmarsat is working with customers to get them through the crisis. One way is ‘how we charge for services,’ and also to use the time for carrying out maintenance. However, furlough schemes have meant that the availability of personnel to carry out the maintenance has been an issue. ‘They (airlines) are focussed on saving their jobs.’

Despite this, Inmarsat has secured ‘pretty significant new deals’ in Europe and Asia which can’t be announced yet.

Inmarsat is well positioned with a wider portfolio of maritime, business aviation and cockpit connectivity sectors. This results in the immediate impact of the crisis on longhaul IFC being diluted according to Balaam.